Unlock the True Value of Your Business

Your Business Valuation, Tailored to Life’s Most Important Moments

At StrateZen, we recognize that business valuations are crucial during life’s pivotal events—whether you’re buying or selling a company, going through a divorce, or dealing with the complexities of a death in the family.

Our comprehensive and tailored approach ensures that you get an accurate and actionable valuation, no matter the scenario.

What is a Business Valuation?

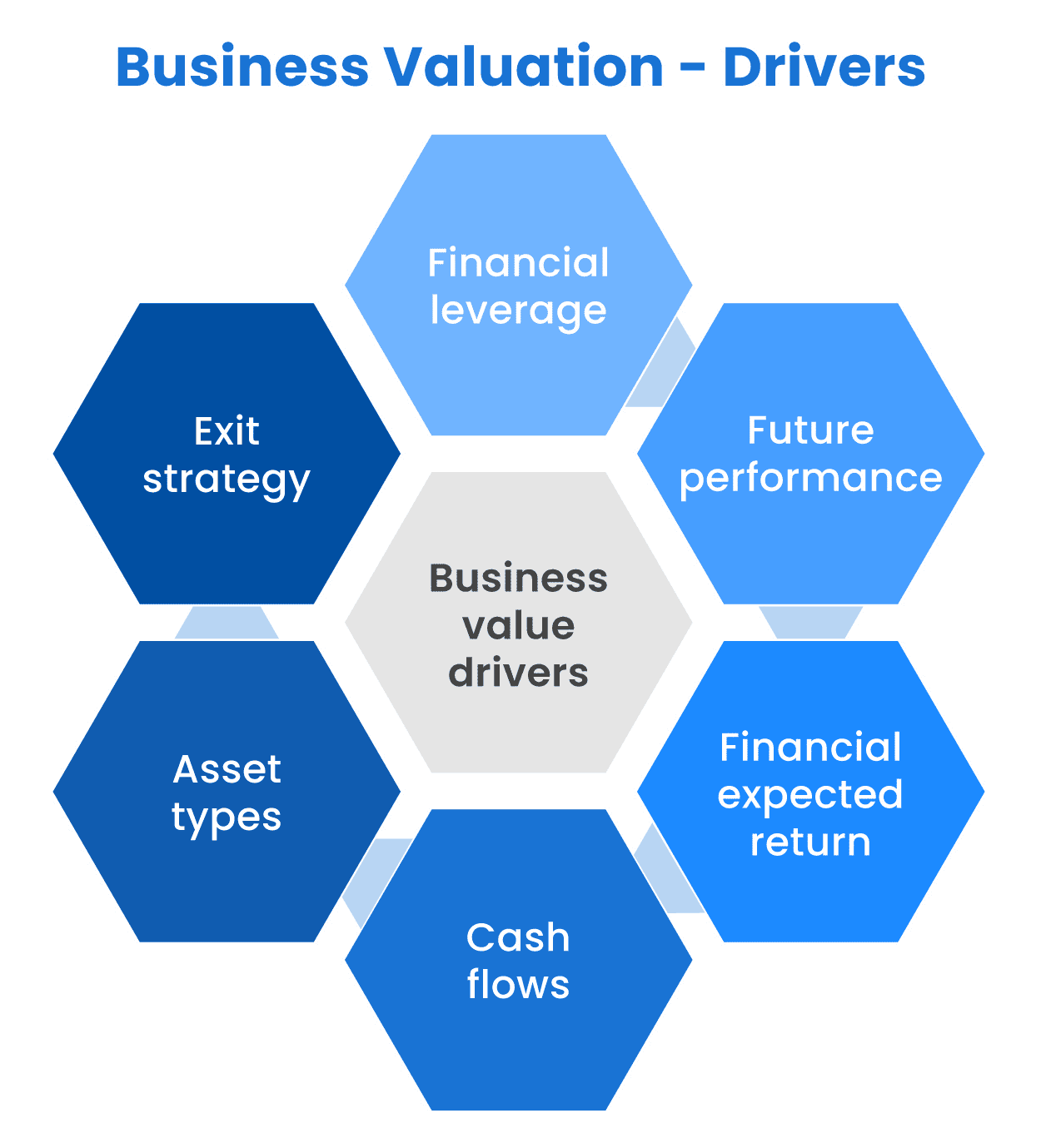

A business valuation determines the true economic worth of a company, large or small. Knowing your business’s value provides an objective measure of its intrinsic value. Whether you’re an investor, business owner, or intermediary, an accurate valuation is essential for making informed decisions about investments, ownership transitions, or strategic growth. Understanding your company’s value is the first step toward maximizing its potential.

Why Get One?